Weights of an optimal portfolio. Put-Call data. (no risk-free asset,... | Download Scientific Diagram

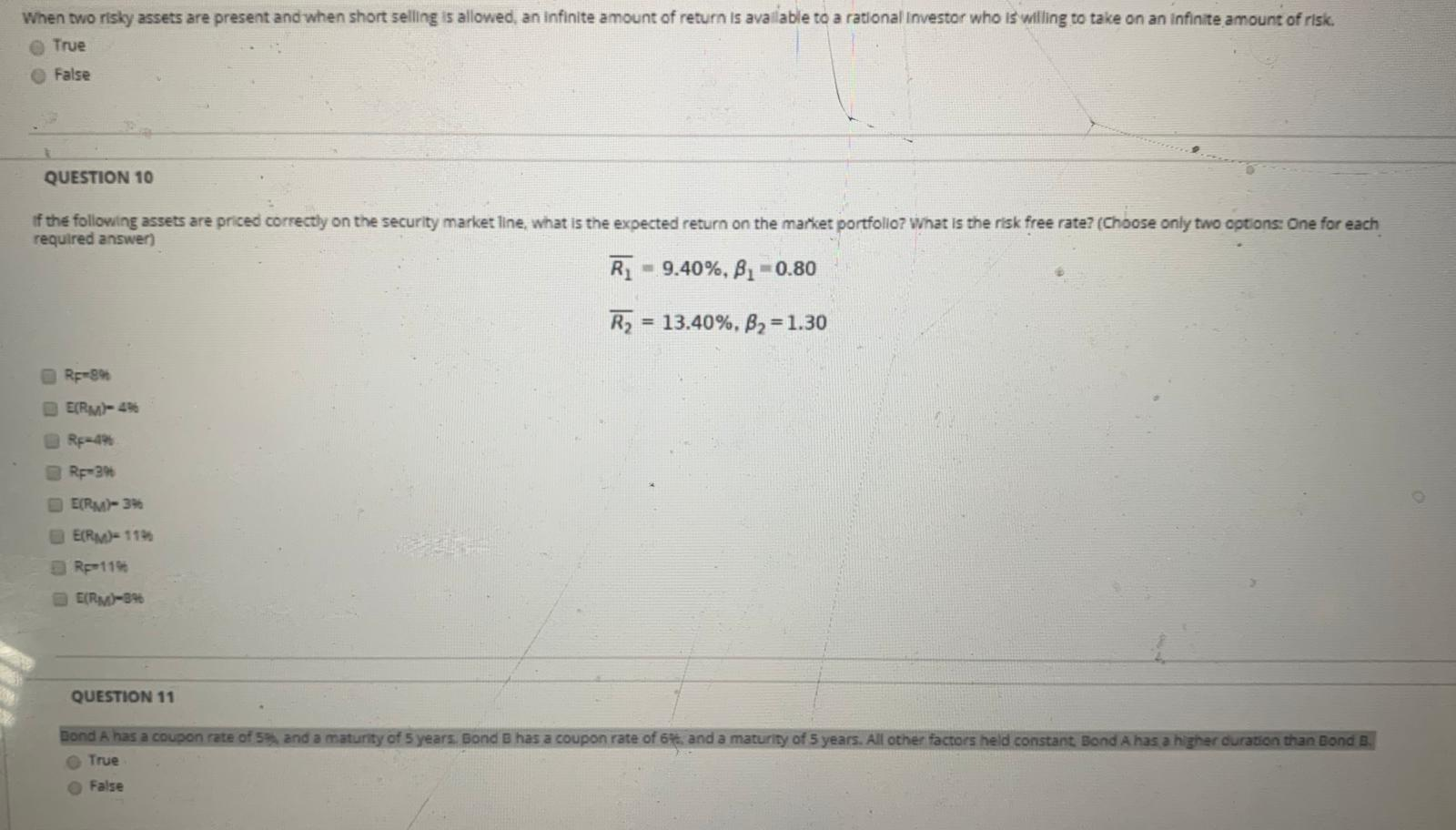

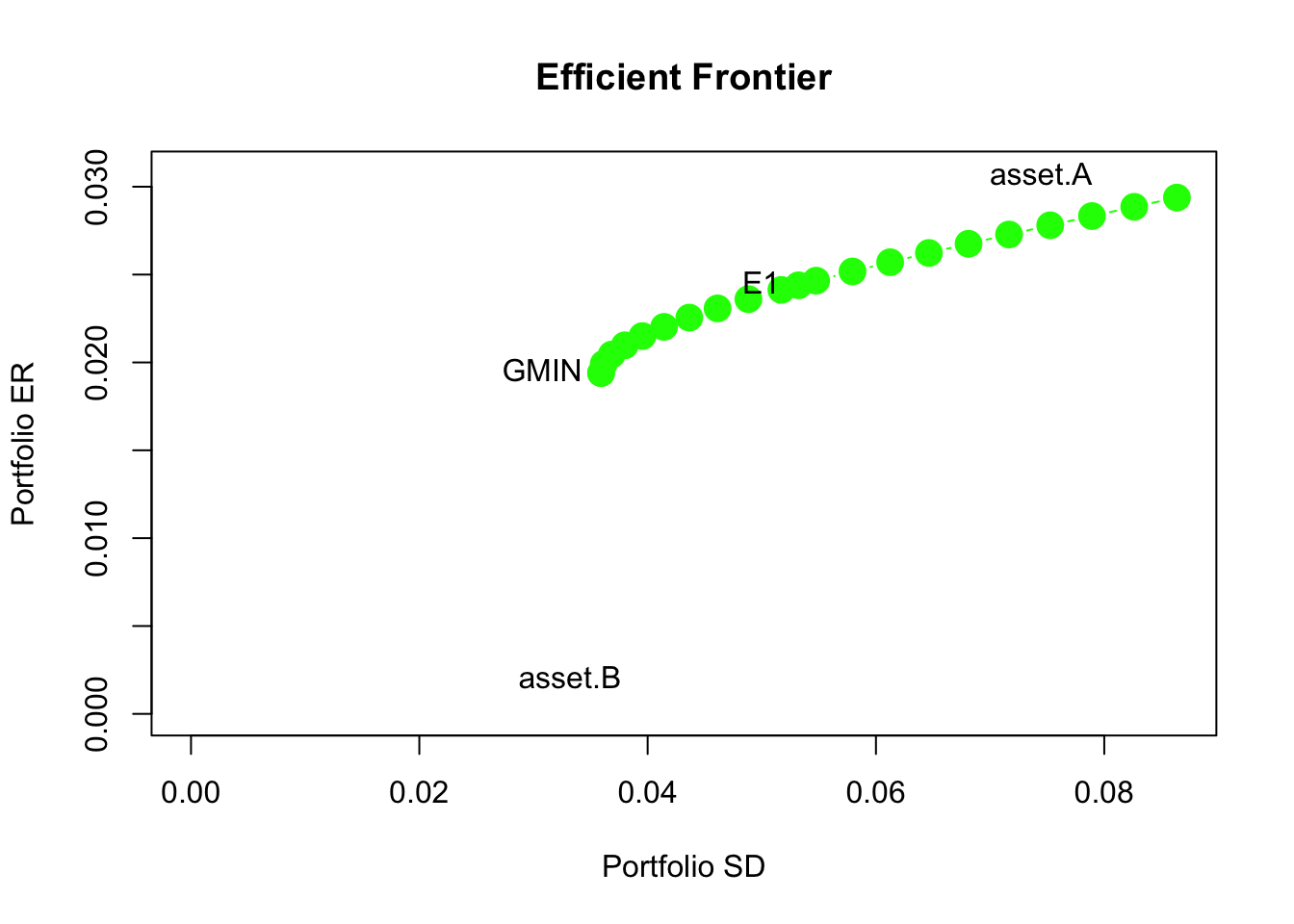

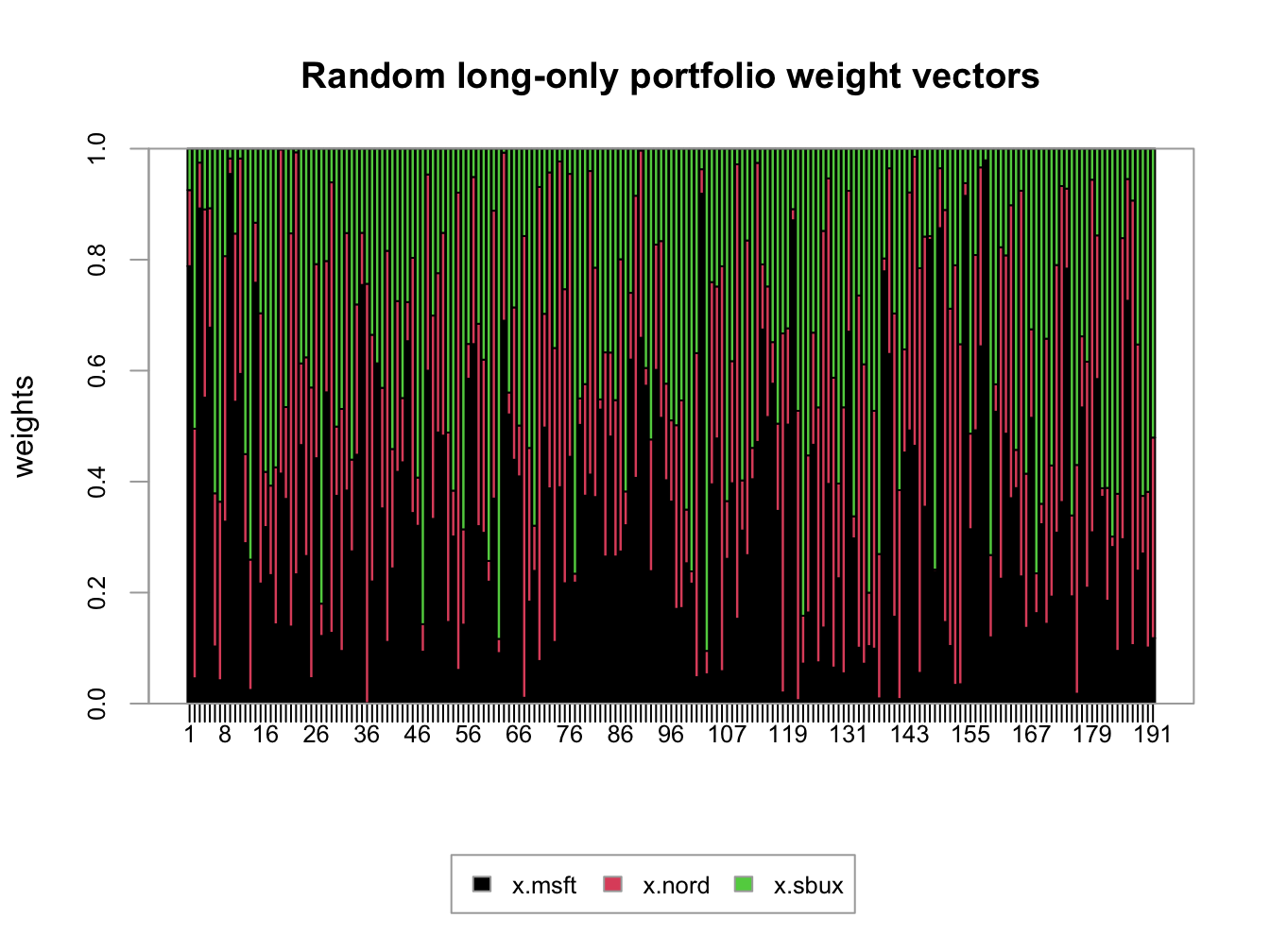

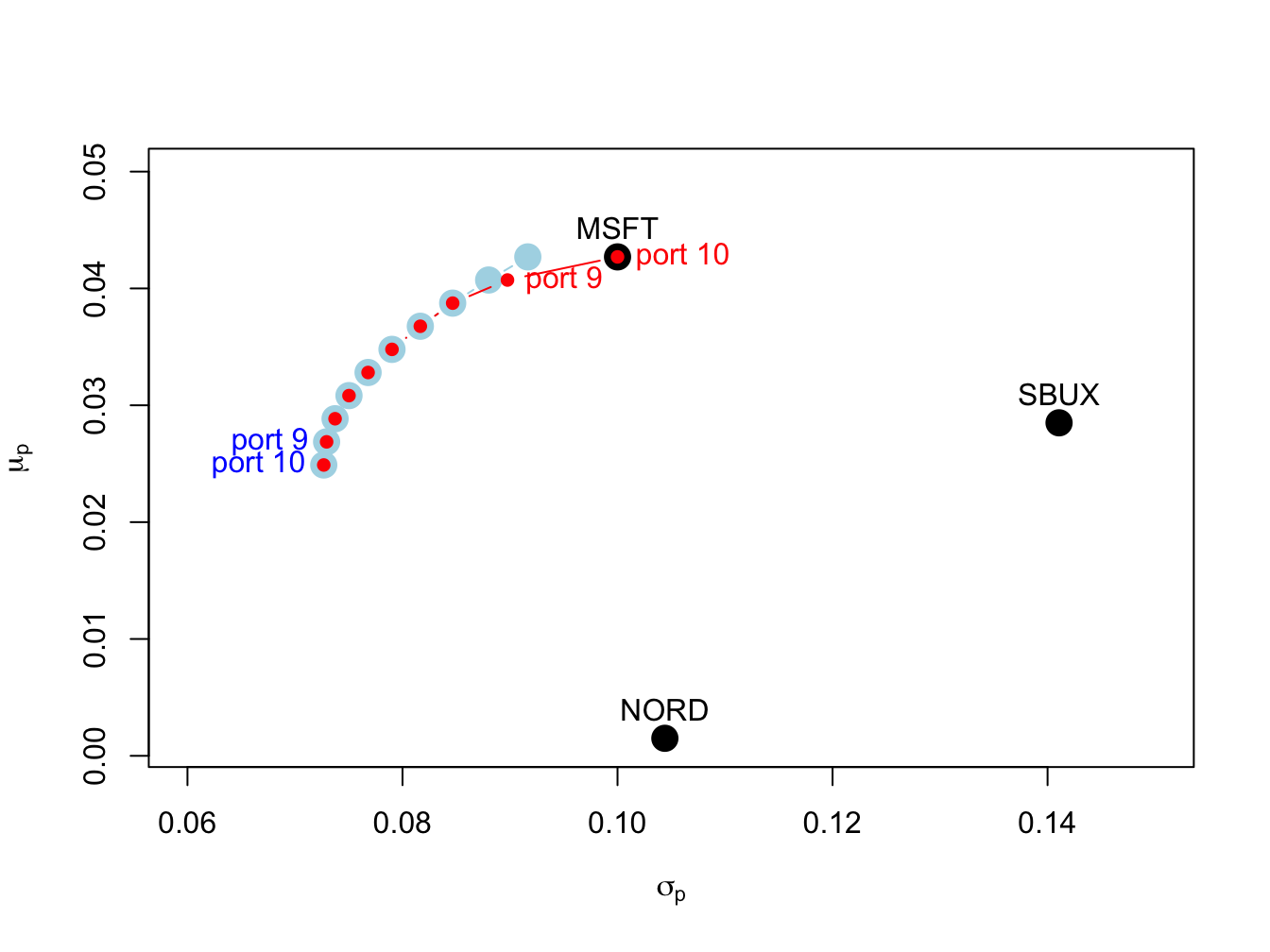

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

![Solved r~≡[r~1r~2]∼N(μ[11],[σ12σ1σ2ρ1,2σ1σ2ρ1,2σ22]) | Chegg.com Solved r~≡[r~1r~2]∼N(μ[11],[σ12σ1σ2ρ1,2σ1σ2ρ1,2σ22]) | Chegg.com](https://media.cheggcdn.com/media/271/2714c682-3ed0-481e-ac01-894bed9037bd/phpqn6EIO)

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Rules_and_Strategies_For_Profitable_Short_Selling_Jun_2020-01-7dfa15ec11914fe38050ce3597fe9939.jpg)

:max_bytes(150000):strip_icc()/Sharperatio-e93b773c49274c828f7508c79d4a18af.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Risk_Free_Is_the_Risk_Free_Rate_of_Return_Feb_2020-96f00395de3d40668f31522801756339.jpg)